can you work part time if you receive social security disability

Special rules make it possible for people receiving Social Security disability benefits or Supplemental. In conclusion you can work part-time while applying for social security disability benefits as long as you earn under SGA.

However if you are younger than full retirement age and make more than the yearly earnings.

. Yes you can work and still receive Social Security disability benefits SSD under the Social Security Administrations work incentive programs. The Social Security Administration allows you to work and provides benefits and incentives for those with disabilities who want to continue working if you meet Social Security. You need to earn a living while you are waiting to get approved for disability benefits though it.

If you are working I highly recommend you retain an. If you have Social Security taxes. If You Go Back to Work.

The short answer is yes. People receiving Social Security disability benefits can work part-time and still receive their monthly payments. But surprisingly thats not the case.

Yes you are allowed to work if you receive Social Security Disability or receive SSI disability. Yes you can work part-time on Social Security Disability as long as your income does not exceed the allowable income limits set by the Social Security Administration SSA. But both SSI and Social Security Disability have rules that govern the treatment of work activity.

If youre like most people you would rather try to work than live on disability benefits. You can get Social Security retirement benefits and work at the same time. The SSA wants you to work.

Generally speaking SSDI recipients cant start doing whats considered substantial. Learn exactly what each incentive entails. You can work part time while you apply for Social Security disability benefits as long as your earnings dont exceed a certain amount set by Social Security each year.

Based on this you would think that working part-time while collecting SSDI benefits would be a definite no-no. The Social Security Administration. The current Social Security tax rate for 2022 is 62 paid by the employer and 62 paid by the employee equaling a total of 124.

There are special rules that help you keep your cash benefits and Medicare. You can work part-time and still get disability benefits. Social Securitys work incentives and Ticket to Work program can help.

Yes you can still work and receive disability benefits but there are limitations on this for both SSDI SSI. The Social Security Administrations Ticket to Work program. Despite the stringent total disability standards applicable to Social Security Disability Insurance SSDI claimants some beneficiaries can work part-time while receiving.

Working a part-time job can help a disabled person emotionally and financially. The Journal of Behavioral Health Services and Research confirms the positive psychological. However your eligibility largely depends on how much you make while working.

Can You Work Part-Time on Social Security Disability.

Can You Work Part Time On Social Security Disability Jsk Law

When Are Medicare Premiums Deducted From Social Security

Does Disability Pay More Than Social Security Smartasset

Can You Work Part Time On Social Security Disability Klain And Associates

Social Security Myth 9 Once Disabled Always Disabled Ssi Gkt Com

Can I Collect Social Security Disability Insurance Ssdi And Work Part Time Youtube

Can I Collect Disability And Work Part Time Disability Advocates Group

What Are My Income Limits On Social Security Disability Benefits Help

Part Time Work And Social Security Disability Youtube

Social Security Disability Friendly Job Income Opportunities Youtube

How Much Can You Earn And Still Keep Your Social Security Disability Ankin Law

Unemployment Part Time Work And Social Security Disability In Oregon Drew L Johnson P C Attorneys At Law

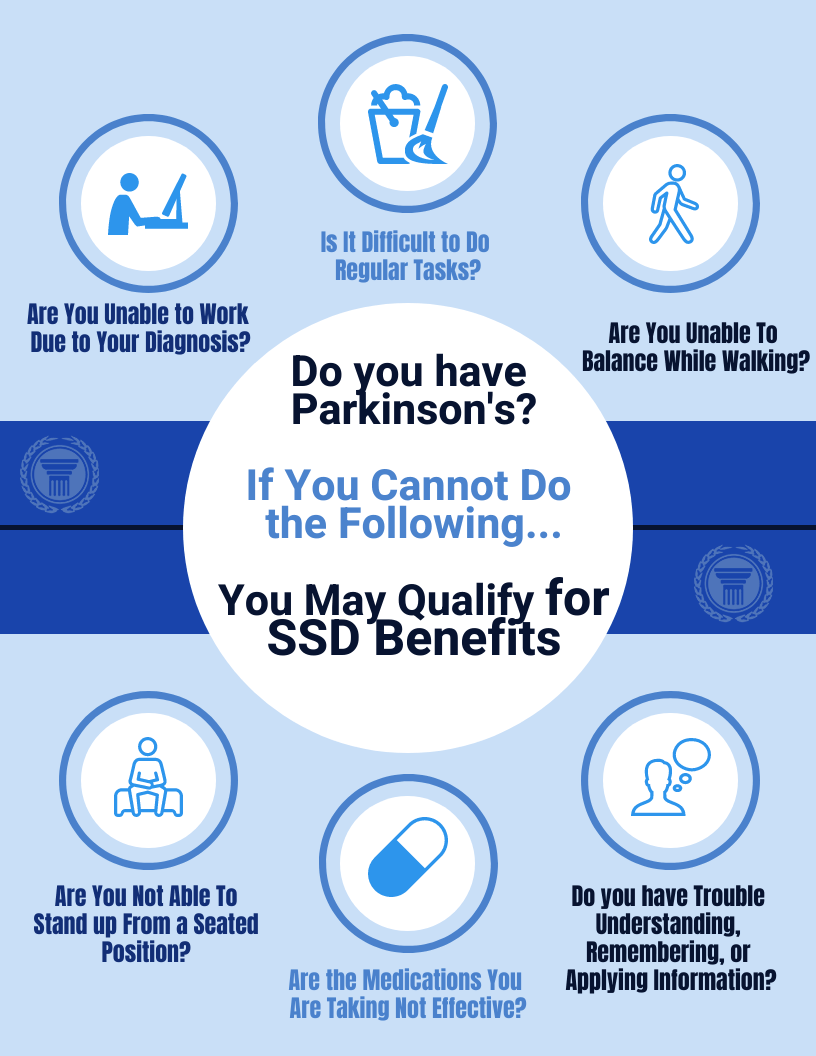

How To Qualify For Disability With Parkinson S Disease In 2022

Working Part Time On Social Security Disability

Investing Social Security Disability In A Roth Ira Ssd Benefits Lawyer

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

/GettyImages-175535394-a9137dddf20f4bcd8925725cfcbc5049.jpg)